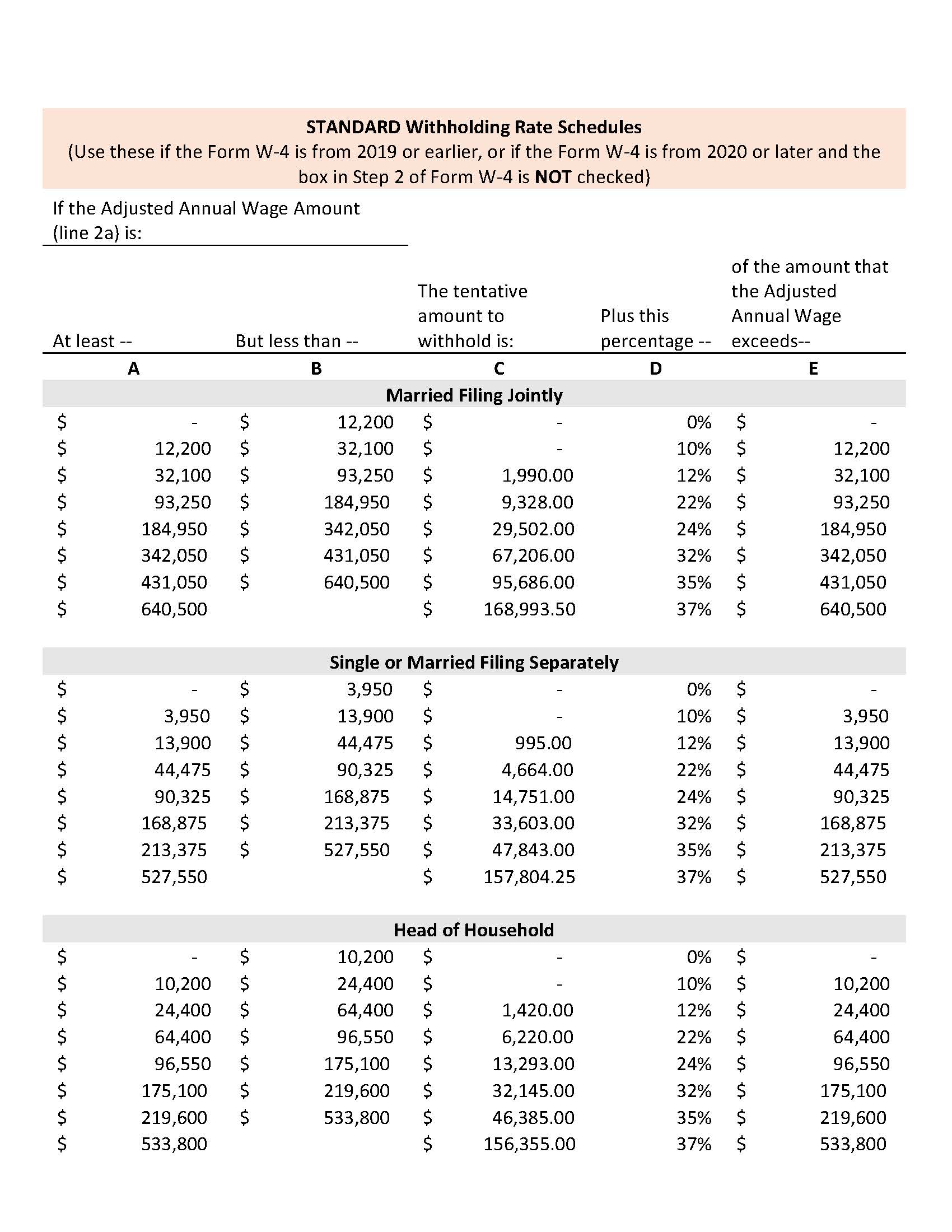

Use these brackets to file your 2022 income tax return. Note that the following brackets are for use in 2024 when your taxes for 2023 (this year) will be due. Difference between “single, married, and head of household” filing status.Loan Payoff Calculator: How Quickly Can You Repay Your Loan?.Auto Loan Interest Calculator: Monthly Payment & Total Cost.

Irs tax tables 2021 how to#

How To Pay Medical Bills You Can’t Afford.Best Car Insurance For College Students.Should You Get Home Contents Insurance?.How Much Should You Contribute To Your 401(k)?.How Much Do You Need To Have Saved For Retirement?.The Beginner’s Guide To Saving For Retirement.Investment Calculator: How Much Will You Earn?.How To File A FAFSA As An Independent Student.Best Companies For Student Loan Refinancing in 2022.Best Personal Loans For Excellent Credit.Understanding Overdraft Protection and Fees.

Balance Transfer Calculator: How much can you save? Tax Brackets and Tax Rates There are still seven (7) tax rates in 2021.Credit Score Calculator: Get Your Estimated Credit Score Range.Where specific advice is necessary or appropriate, Schwab recommends consultation with a qualified tax advisor, CPA, financial planner, or investment manager. This information does not constitute and is not intended to be a substitute for specific individualized tax, legal, or investment planning advice. Investing involves risk including loss of principal.Įxamples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve. However, its accuracy, completeness, or reliability cannot be guaranteed. Data contained herein from third-party providers is obtained from what are considered reliable sources. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.Īll expressions of opinion are subject to change without notice in reaction to shifting market conditions. The investment strategies mentioned here may not be suitable for everyone. The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. Just be sure the potential refund is worth the additional paperwork and any associated preparation costs.

That change has since been repealed, so if you calculated your child's liability using estate and trust tax rates, you may have the option to file an amended return using your tax rate for your child's unearned income instead. The Tax Cuts and Jobs Act of 2017 effectively raised the kiddie tax by basing it on the tax rates used for estates and trusts, instead of the rates used for parents. If your family paid the kiddie tax in prior years, you could be eligible for a refund. To learn more, see IRS Publication 929 1 or consult a tax advisor. If your child also has earned income, say from a summer job, the rules become more complicated.

0 kommentar(er)

0 kommentar(er)